>

Block of apartments for sale

Investment Opportunity: Sports Residential Building Development - Culham Road, Abingdon-on-Thames, Oxfordshire, OX14

£100,000

Investment Opportunity: Sports Residential Building Development - Culham Road, Abingdon-on-Thames, Oxfordshire, OX14

£100,000

Our Summary

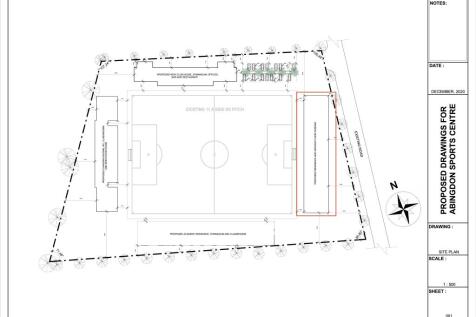

- Parking & Community Affordable Housing - Investment Opportunity Location: Abingdon Sports Centre Type: Community & Affordable Apartments + Elevated Parking Structure Investment Options: ROI %, Capital Gain, Hybrid Projected Financials Allocation Summary: Approx

- 10M Target Yearly Revenue: £310K Target ROI: 7-9% Projected Capital Uplift:

- Why This Investment Stands Out Eligible for Homes England Affordable Housing grants Community housing designation can support planning approvals Rental backed by long-term local demand Parking revenue from match days, tournaments & events Efficient land-use value uplift from elevated design Investor Options Fixed ROI backed by residential rental income + parking revenue Capital Gain from early-stage development uplift Hybrid options available on request

- Community Planning Advantage Affordable units + public parking significantly improve planning approval strength and local authority support

- Land Use Efficiency = Value Uplift By building above parking, the same footprint delivers two income layers, maximising land performance

- Sustainable Construction Narrative Potential for low-carbon build, solar canopy parking roof, green walls, and centralised energy efficiency

Description

This investment opportunity presents a unique development that combines community and affordable apartments with an elevated parking structure, situated above the Abingdon Sports Centre. The project is expected to generate a 7-9% target ROI, with a projected capital uplift of 65%. The development's modern design maximizes usable land area, providing reserved resident parking, large-capacity spectator and public parking, and modern apartments. The project is eligible for Homes England Affordable Housing grants and has a long-term local demand for rentals, backed by parking revenue from events and match days. Investors can choose from fixed ROI backed by residential rental income and parking revenue, capital gain from early-stage development uplift, or hybrid options.